Directed Accumulation of Volume for Scalping

Directed Accumulation of Volume for Scalping shows direction a trend is predisposed to. Wait for divergence of the indicator and a price to enter the market (divergence means a situation when the price is growing or is not falling, and the indicator is falling).

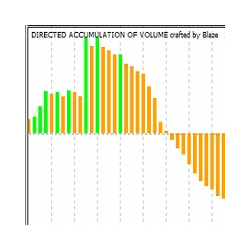

- The screenshot below demonstrates an example of SELL entry.

- Do quite opposite to enter a BUY position.

The idea to develop such indicator came over me when I realized what really moves a price — greed and fear fortified by hope. Greed makes us to open a position when a current trend is obvious, and fear makes us to close a position in loss, when a mistake is obvious, ANOTHER MISTAKE!

Thinking logically we can came to wrong conclusions. For example if everybody come to the market and see the upward trend, they all will want to buy. But who will sell? Who will sell the same amount? The price will continuously follow the trend affected by new demand as the Market Depth above the price has fewer and fewer sellers and the price is moving up easily. And old bulls gain new profit, and greed makes them invest this profit again. Moreover their contractors will buy their short positions at a loss. Doing this they BUY following the market, moving the price higher, finding new sellers and transferring them losing contract with a buyer... And so on.

But reality is much more different. I could run on this topic for hours, as I have so much information about it in my head that I could write a book. But I will try to give just brief key data here.

I think that it is commonly known that majority of markets have liquidity providers: powerful or intelligent money, market makers (MM) etc. A name does not alter the essence.

At particular moments the crowd polarizes from emotions and stay at one side: everybody open positions at one points, close positions in another points, open positions in third points... That is how powerful money can absorb all this liquidity and STOP, for example, upward price movement creating local overbought (all, who wanted to buy, has bought, and nobody wishes to sell as upward trend is too obvious).

There are even such terms on the Internet: "accumulation" and "distribution". That is what I am talking about. Creating local overbought at a certain moment (different time frames might have different situation at a time) powerful money create disbalance of demand and supply accumulating volume of its position in opposite direction. You just need to push the market to the first stops, and chain reaction will start automatically - it will be a new local trend or a pullback of a global trend, a name does not matter :)

Let's go back to the indicator. Actually, there are two of them. They have the same calculation algorithm but values are displayed differently.

- Direction of volume increase — volume of every tick is accumulated inside each bar of candle. Volume is added with a glance to bullish or bearish direction of this trend. The DELTA is fixed between bullish and bearish volume after closing of each candle.

- Accumulation of volume increase — volume of every tick is accumulated inside each bar of candle. Volume is added with a glance to bullish or bearish direction of this trend. After a candle is closed the delta is added with a glance to its value to the value of the indicator on the previous bar. After this the ACCUMULATED delta is fixed.

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: