Spread Hunter

Spread Trading Basics

The basic principle of Spread trading (Pair Trading) is to first identify two assets (they can be stocks, indices, commodities) that show a good historic correlation. Despite a good long-term correlation, sometimes this pricing makes on Asset A to be relatively cheap or expensive compared to Asset B. It can be certain news or just some buying or selling pressure in one of the assets causing the prices of A and B to diverge.

The most commonly traded strategy is "Revert to mean" which relies on the presumption that the prices of the two assets eventually will converge back to their mean and continue to follow the established historical good correlation.

So, if Asset A becomes too cheap relative to Asset B, we enter a long position in A and at the same time we establish an equally sized short position in B. Consequently, if Asset A becomes too expensive relative to Asset B we enter a short position in Asset A and a long position in B. We now have a so-called hedged position, and it does not matter if the general market goes up, down or sideways. For us the only important thing is that asset A develops relatively better than B. So, even if both drop in value that is ok as long as B looses more in value than A. Please note that with equally sized position, I refer to the same money value on both sides. So, if you for instance are long 10 000 USD Asset A you should enter an equally sized 10 000 USD short position for Asset B.

To evaluate the deviation from the mean, the indicator uses the Bollinger Band. When the spread is out of the band and then reverts, Spread Hunter sends the signal.

The quality of the signal depends on the period of Bollinger Band and its deviation factor related to the history and correlation of the two assets.

Now, SPREAD HUNTER makes all this AUTOMATICALLY, you only must choose the two assets, and SPREAD HUNTER will calculate ALL AUTOMATICALLY!

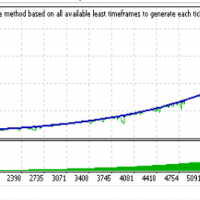

SPREAD HUNTER shows you the backtest of best settings found by the indicator for the period (DaysBack setting) and recalculates it every day.

Parameters

- SubSymbol - the second symbol, the first is the asset on the chart.

- DaysBack - the number of days Spread Hunter uses to show the spread.

- MinProfPercent - the profit filter, if the potential profit is less than this level, Spread Hunter does not show the signal.

- AutoBBPeriod - if true, the Bollinger Band period is calculated automatically.

- BBPeriod - manual Bollinger Band period if AutoBBPeriod = false.

- AutoKstd - if true, the standard deviation of the Bollinger Band is calculated automatically.

- Kstd - manual standard deviation, if AutoKstd = false.

- Risk - if > 0, Spread Hunter calculates the lot size of the assets based on risk % of the account balance.

- R_R_Ratio - the risk reward ratio of the operation.

- Invested_Money - the money you want to invest if Risk = 0.

- alert_ - if true, Spread Hunter shows a popup alert when the signal arrives.

- SendMail_ - if true, Spread Hunter sends an email when the signal arrives.

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: