MACD Arbitrage

Arbitrage (from French Arbitrage – fair decision) in economics means several logically related deals aimed to profit from the difference in prices for the same or related assets.

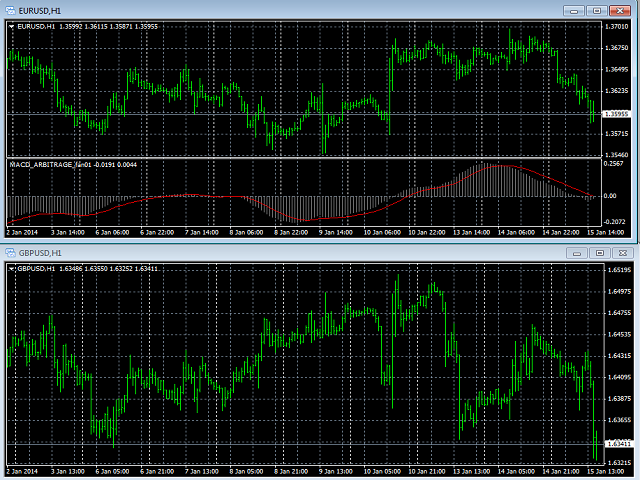

MACD Arbitrage displays price divergence between two correlating symbols. The indicator is applied to the window containing one of the correlating symbols (for example, EURUSD), while the name of the second symbol is set in the indicator parameters (for example, Ins2 = GBPUSD).

FastEMA and SlowEMA parameters are used for setting fast and slow MA periods. SignalEMA – indicator signal line period.

Interpretation: If the indicator's value is well below zero, the price ratio of the current symbol relative to the second one is considerably lagging behind the average value. Thus, it is time to buy that symbol. The similar volume of the second symbol should be sold simultaneously. The price will most probably "catch up" with the common level or the second symbol's price will drop down to that level. Both deals should be closed simultaneously.

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: