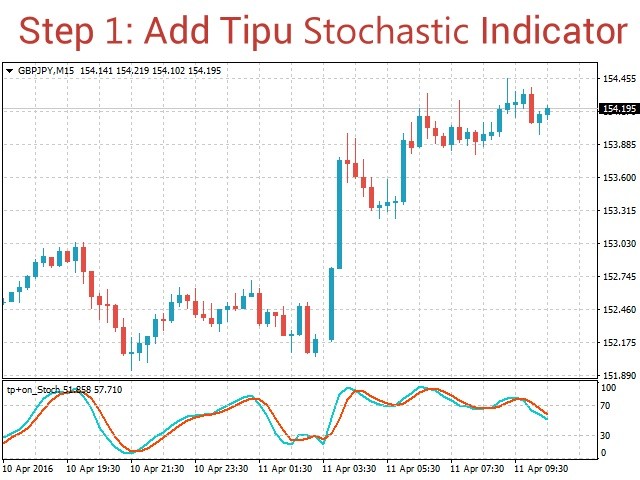

Tipu Stochastic

Tipu Stochastic is the modified version of the original Stochastic Oscillator published by metaQuotes here.

Features

- Choose three types of signals (Reversals, Main Signal Cross, and Overbought/Oversold Cross).

- Customizable Buy/Sell alerts, push alerts, email alerts, and visual on-screen alerts.

- Marked overbought and oversold levels.

Add Tipu Panel (found here) and unlock the following additional features:

- An easy to use Panel that shows the trend + signal of the selected time frames.

- Show Stochastic values for the selected time frames.

- Customizable panel. The panel can be moved to any place on the chart or minimized to allow more space.

Stochastic Oscillator was devised by George C. Lane in 1950s. It is a momentum indicator that compares the security price close relative to it price range (high - low) over a period of time. According to George Lane, the Stochastic Oscillator does not follow price, it doesn't follow volume or anything like that. It follows the speed or the momentum of the price. As a rule, the momentum changes direction before the price.

How to use

The Stochastic Oscillator goes up when the security price closes in the upper ranges (meaning close is near the high of the period). In a strong trending market, the stochastic can stay in overbought/oversold conditions for a extended period of time. A trade signal may be generated when the stochastic crosses overbought/oversold levels. It may also be generated when the main line reverses direction and starts trending in opposite direction. Stochastic may also be used for the divergence signals. Divergence occurs when the Stochastic directional movement is not confirmed by the price action. For example, a bullish divergence occurs when EURUSD makes lower low but the Stochastic makes higher low. This means that EURUSD is losing momentum and a bullish correction is possible.

The Stochastic crossovers give powerful trading signals when used in conjunction with the trend-line violation, the candle formation, and the support and resistance levels.

Calculation

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: