Mean Reversion Supply Demand MT4

Supply Demand with Mean Reversion Concept

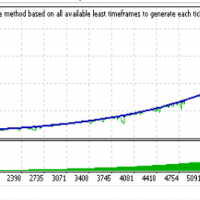

The concept of supply demand trading rely on the quantity mismatching between buying and selling volumes in financial markets. To typical traders, supply demand zone serves as the turning point. When we looked at its original concept, we have found that the original supply demand trading can be performed better at mean reversion period rather than trend period. For the demonstration of this concept, for any supply demand zone to work as an successful trade, the price must touch the base zone, move away and then return to zone again. Finally our trade will be placed and the price need to move away from zone again. For the successful supply demand trading, zigzag movement of the price is essential. This type of zigzag movement is also the typical mean reversion characteristics. We could not believe that no traders spot the supply demand trading in depth in terms of the mean reversion concept. Here we present the algorithm and trading strategy based on supply demand zone in the mean reversion concept.

Features of our Mean Reversion Supply Demand

- Automatic profit target and stop loss detection for any supply demand zone

- Daily, Weekly and Monthly Market Profile Analysis to further gauge the mean reversion characteristics of market (Value area and point of control calculation included.)

- Daily, Weekly, Monthly Pivot Analysis to improve your mean reversion analysis

- Capability to do multiple time frame analysis on the same chart. (Simultaneous use of hourly, 4 hourly and daily supply demand zones are possible.)

- Automatic Retouch detection of each supply demand zone. (Easy to identify which zone is virgin and which are not.)

- Sound, Email, Push notification is possible when any supply demand zone is touched or for selected zone only (Recommended mode).

How to use Mean Reversion Supply Demand

Our tool offer daily, weekly and monthly Market Profile to gauge the odds of the mean reversion for the market. To construct the market profile, the timeframe for chart must be carefully chosen for the proper calculation of Market Profile. Normally it is important to recognize the price movement outside the value area. Daily market profile might offer you short term mean reversion opportunity comparing to weekly and monthly.

- Daily Market Profile: M5 to H1 timeframe can be used. M30 is recommended.

- Weekly Market Profile: M30 to H4 timeframe can be used. H1 is recommended.

- Monthly Market Profile: H1 to D1 timeframe can be used. H4 is recommended.

Beside the market profile analysis, you can also add daily, weekly and monthly Pivot Analysis to improve your accuracy. To detect valid supply demand zone, we recommend to use two or three timeframe at the same time in one chart to detect valid zone. For one example, you can open hourly chart and you can apply our Mean Reversion Supply Demand to detect hourly and 4 hourly supply demand zone in the same chart. Supply and demand zone confirmed in multiple timeframe normally offer better odds for your trading. When you have found the good supply demand zone for trading, click on Box of the Supply or Demand zone to see your trading setup including target profit, stop loss level (Fully automatic).

Further Note

Make the best use of our Selected Zone only alert system. When you are using this tool alone, we recommend to use Market profile and Pivot Analysis together to make your decision plus some simple trend indicator to ensure that you are not against long term trend. At the same time, hybridizing supply demand strategy with our other powerful tools can yield better results. Hybridization can always improve your odds of success in your trading. We offer diverse range of trading tools for serious traders.

- Harmonic Pattern Plus

- Harmonic Pattern Scenario Planner

- Price Breakout Pattern Scanner

- Sideways Market Analyser

- Elliott Wave Trend

important Input

- Use supply demand zone: use this to switch on and off supply demand zone detection.

- Timeframe for Calculation: Set this to timeframe for multiple time frame analysis

- Strength at Origin: 0 to 2 only (2=default, recommended)

- Bars to Scan: amount bars for computation for supply demand calculation

- Max Reward to Risk Ratio: Your preferred maximum reward/risk

- Min Reward to Risk Ratio: Your preferred minimum reward/risk

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: