Fixed ratio lot calculator MT4

Fixed ratio lot calculator

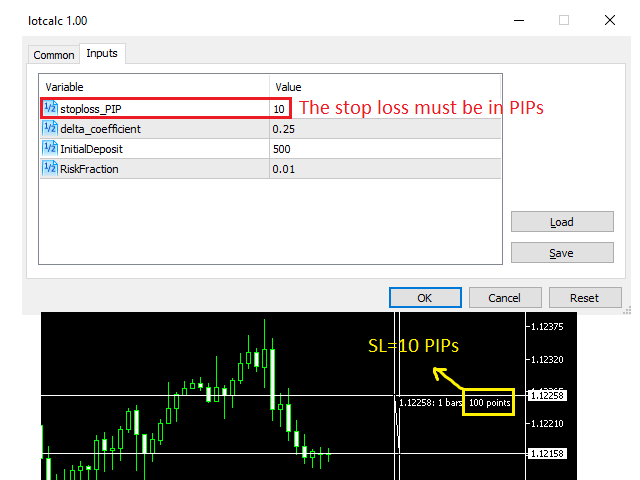

have you ever struggled with calculating lot size while trading fast markets? You may have decided to use a fixed lot size to get rid of these time consuming calculations. But this is not a very good idea because definitely your stop loss is not always a fixed amount of PIPs thus it can impose a lot of fluctuations on your account. On the other hand, all of these methods that say "risk only 1% of your account in every trade or trade only 1 lot or any fixed lot size", are fixed fractional methods which are not as powerful as FIXED RATIO method. The only problem with fixed ratio trading is calculations that should be done according to your current Equity. This calculator has solved this problem and can calculate proper lot size according to fixed ratio trading.You may ask "what is fixed ratio trading?!". Don't worry. I will tell you in one example. Suppose that you are a trader who has an account with an initial deposit of 10000$. If you risk 1% of your account on a per trade basis, you will be initially risking 100$ per trade...but if you make 500$ (grow your account to 10500$) you will be risking again 1% (105$). Now:

10000$ (Equity) >>>>>>>>>100$ risk

+500$ 10500$ (Equity) >>>>>>>>>105$ risk

+1000$ 11000$ (Equity) >>>>>>>>>110$ risk

...

and it will continue... Did you notice the problem? Yes, right. It will cause fluctuation on your account because you are risking different numbers of dollars every time. This was the common fixed fraction method that is used by a lot of traders.I have not yet explained the fixed ratio but before that let me tell you the other type of fixed fraction method which is "trading 1 (or any fixed number) contract for every 10000$ (or any fixed number). This statement can be changed a little bit in Forex market to:"risking 100$ (or any fixed number) for every 10000$ (or any fixed number). it means that you can not risk more than 100$ until you reach to 20000$. The good news is that the fluctuation does not exist but the bad news is that "Smaller accounts, risking a reasonable percentage on every trade, will have to wait a very long time as a general rule to begin benefiting from money management." Ok, let's talk about fixed ratio trading. The most important thing about this method is Delta. What is delta? A fixed number! For this example let's say delta is 2000 dollars. look at this table

| Equity($) | Delta ($) | Risk/Trade($) | |

|---|---|---|---|

| 1 | 10000 | 2000 | 100 |

| 2 | 10000+1*2000=12000 | 2000 | 2*100=200 |

| 3 | 12000+2*2000=16000 | 2000 | 3*100=300 |

| 4 | 16000+3*2000=22000 | 2000 | 4*100=400 |

You may have noticed that the number delta palyes a key rule in this method:" the bigger the number the more conservative the trader and the smaller he number the more aggressive the trader." This was a brief explanation of fixed ratio trading and I don't want to tell more about the mathematics and formulas which are used in this method. The good news is that you don't have to know more than this to be able to use this calculator.This calculator can be used only in 5 digits accounts. For more information look at the screenshots.

本店最新上架

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

全网为您推荐

-

- AlgoTradeSoft

- ¥3988.00

-

- 国际期货套利软件

- ¥3988.00

-

- MT4 MT5跟单EA 本地跟单远程跟单 绝不

- ¥1100.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

-

- 在MetaTrader市场购买MetaTrader 5的&#

- ¥3988.00

客服热线:

客服热线: